NEWYou can now listen to Fox News articles!

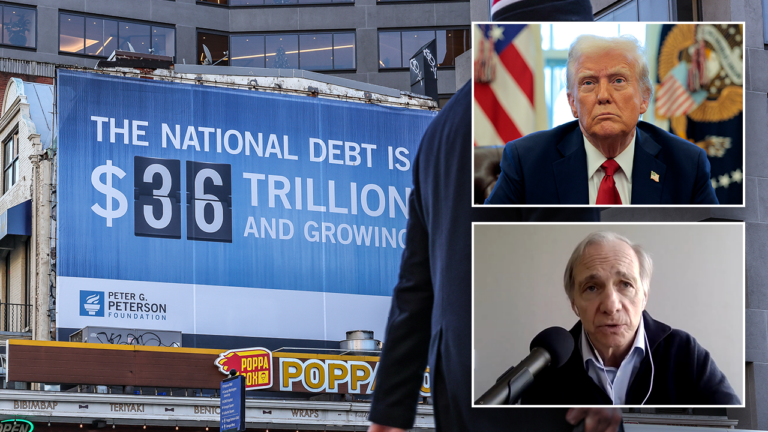

While it appears that every day Americans may be DOGE-ing more waste, fraud and abuse in the federal government, unfortunately, America is on an unsustainable financial path and the numbers don’t lie. The national debt has surged past $36.5 trillion, with no signs of slowing down. Both parties are complicit, but it is the left’s relentless push for government expansion, social programs, and reckless spending that has put us on the trajectory toward an inevitable $40 trillion in debt.

The fiscal budget line items nobody mentions

When you closely examine what’s happening with the fiscal budget, there are only four-line items that are substantive to the overall expenditures in the United States. Here they are:

1. Healthcare programs (Medicare and Medicaid)

These programs collectively account for approximately $1.67 trillion a year of spending, representing 24% of the federal budget. Medicare provides health coverage to seniors, while Medicaid assists low-income individuals. The aging population and rising healthcare costs make it challenging to curtail spending in this area.

DOGE INITIAL FINDINGS ON DEFENSE DEPARTMENT DEI SPENDING COULD SAVE $80M, AGENCY SAYS

2. Social Security

With an annual expenditure of about $1.5 trillion, Social Security constitutes 21% of the budget. It offers retirement and disability benefits to eligible citizens. Given its role as a primary income source for many retirees, any attempts to reduce benefits face significant political resistance.

DOGE is cutting the budget. It’s a good start and not enough. FILE: The U.S. national debt has exceeded $36 trillion. (All-In Podcast/Jemal Countess/Peter G. Peterson Foundation/Chip Somodevilla/Getty Images)

3. Net interest on the debt

Here lies the part of the problem on why $40 trillion in debt is inevitable. Interest payments on the national debt are at a staggering $1.1 trillion dollars a year, comprising 15.6% of the budget. As the debt grows and interest rates rise, these debt payments are akin to a household that has runaway credit card debt on a one-way dead-end path to bankruptcy.

4. Defense spending

The defense budget stands at approximately $884 billion, accounting for 12.5% of federal spending. This includes funding for military operations, personnel, equipment, and research. National security concerns and geopolitical dynamics make defense cuts politically sensitive.

When you add up all four of these line items, it’s almost 73% of the overall fiscal budget. For certain, it makes sense to shake the federal government upside down like you were looking for coins in a couch because that is a start to reduce the overall government spending. However, it won’t make up for the money we still need to run these three major programs and as interest rates stay high, our own debt sinks us deeper and deeper into a hole.

Reducing spending in these areas is fraught with challenges. Healthcare and Social Security are vital to millions, and any cuts could have widespread social implications. Defense spending is closely tied to national security, making reductions politically contentious. Interest payments are obligatory; as the debt escalates, so do these payments, creating a vicious cycle.

What about generating more revenue? The 3 largest revenue streams

Federal revenue is currently pacing to be a little bit more than $5 trillion dollars and, despite the buzz about tariffs and other taxes, we really get revenue from three sources:

1. Individual income taxes

These taxes contribute approximately 51.6% of total federal revenue. When you hear the rally cry of “tax the rich,” considering that almost 50% of Americans do not pay any federal income tax at all, it’s a stark reality that the main way you grow revenue is to get the people who are making lots of money to pay more. Increasing income tax rates is politically challenging and could discourage economic growth since the highest levels of income are earned by those who start the businesses and create the jobs for Americans.

2. Payroll taxes

Accounting for about 33% of federal revenue, payroll taxes fund social insurance programs like Social Security and Medicare. Remember, this largely includes the 6.2% you pay for Social Security, 1.45% for Medicare, and unemployment taxes. Multiple proposals have been discussed over the past 25 years about how to overhaul income from these sources, including an infinite tax on your income for Social Security, increasing the Social Security tax over the next ten years to 7.2%, and extending the normal retirement age for those born in 1980 and after to the age of 70.

3. Corporate income taxes

Sadly, people complain that if President Donald Trump lowers taxes on corporations, it could badly damage the economy. The reality is the taxes provided by corporations only equal a paltry 9% of federal revenue. Even if tax rates on corporations went back to 35%, the tax revenue earned from this change could pale in comparison to making the United States competitive for companies to locate in our country.

Elon Musk’s efforts to cut the federal government are only chipping away the $36 trillion national debt. FILE: Musk speaks at the Conservative Political Action Conference (CPAC) at the Gaylord National Resort Hotel And Convention Center on February 20, 2025 in Oxon Hill, Maryland. ((Photo by Andrew Harnik/Getty Images))

Expanding revenue from all these sources is problematic. Higher individual taxes can dampen consumer spending and savings. Elevated payroll taxes place a burden on both employees and employers, potentially affecting employment rates. Augmenting corporate taxes may drive businesses to relocate operations abroad, diminishing the domestic tax base.

The political reality: DOGE is a start, but both sides must give in to fix this problem…

So far, DOGE estimates over $100 billion in savings. This is a combination of asset sales, contract/lease cancelations and renegotiations, fraud and improper payment deletion, grant cancelations, interest savings, programmatic changes, regulatory savings and workforce deductions. Let’s not make light of the fact that $100 billion dollars is meaningful, but it’s a far cry from closing the gap on the $2 trillion-dollar fiscal deficit we are running now, with half of that deficit being the net interest on the debt.

CLICK HERE FOR MORE FOX NEWS OPINION

What Americans hate most is hearing bad news or difficult news, which is why we elect new presidents who have great approval ratings until they start making the hard changes. Nobody likes the hard changes. Approval ratings go down and politicians adjust to become more favorable to the American public.

While Republicans talk about fiscal responsibility, they have largely abandoned the fight for balanced budgets. We need one now in the worst way possible. The national debt surged under both Presidents George W. Bush and Trump, proving that even so-called conservatives are willing to spend freely when it suits their agenda.

The reality is the taxes provided by corporations only equal a paltry 9% of federal revenue. Even if tax rates on corporations went back to 35%, the tax revenue earned from this change could pale in comparison to making the United States competitive for companies to locate in our country.

Meanwhile, Democrats openly embrace massive government expansion, arguing that “deficits don’t matter” and that the rich can simply be taxed more to cover the cost. It’s always the Democratic answer, play Robin Hood. Take from the rich and give to those who deserve it more (even after you busted your tail to earn it).

The truth is, taxing the wealthy will never be enough. Even if the government confiscated all the wealth of America’s billionaires, it would barely make a dent in the national debt. The only real solution is to both cut spending and increase taxes at the same time, but there is no political will on either side to do so. Any attempt at fiscal restraint is met with fierce opposition from special interest groups and politicians, media outrage and accusations of cruelty on one side or the other.

The path forward: we are stuck, and it’s why we will hit $40 trillion

The U.S. is racing toward $40 trillion in debt, and the consequences will be severe. Inflation, economic stagnation and a declining global standing are just a few of the risks we face if we don’t get our fiscal house in order.

CLICK HERE TO GET THE FOX NEWS APP

When your kids cry in the candy store, do you always give in and buy them a piece of candy? The answer is no. The answer is not what Americans want to hear. The answer is it’s time to avoid a full-blown economic crisis through serious spending cuts, entitlement reform and a return to sound fiscal policy. This won’t be easy, and it won’t be popular, but the alternative — a bankrupt America — is far worse.

Unless we do something soon, Washington’s addiction to spending and a political class unwilling to make tough choices, hitting $40 trillion in debt isn’t just possible — it’s inevitable.

CLICK HERE TO READ MORE BY TED JENKIN