Bitcoin continues to consolidate just below its all-time high of $112K, holding firmly above key support at $105K despite repeated bearish attempts to push the price lower. This tight trading range reflects market uncertainty, yet the structure favors bulls as long as support levels remain intact.

Related Reading

Meanwhile, macroeconomic conditions are evolving rapidly. The US Congress recently passed President Donald Trump’s “big, beautiful” economic package ahead of the self-imposed July 4 deadline, signaling a new phase of fiscal stimulus marked by tax cuts and aggressive spending. Combined with strong job reports, these factors suggest inflation may soon accelerate — a trend that historically supports Bitcoin as a hedge against fiat devaluation.

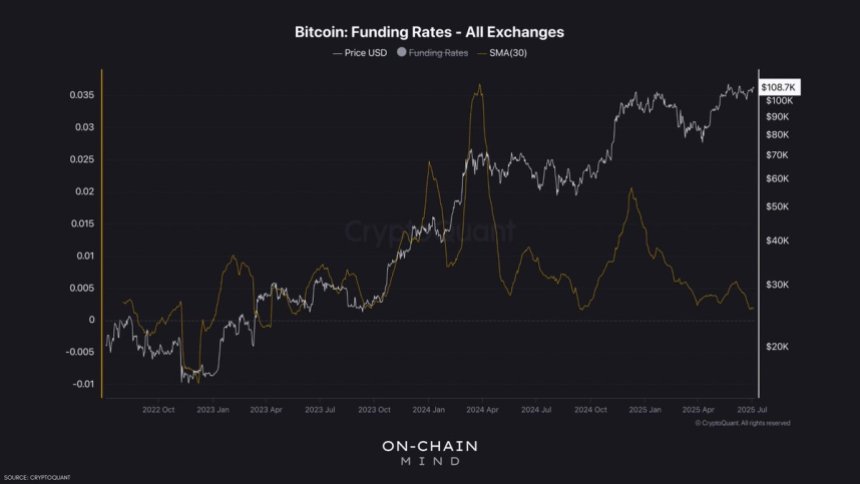

On the market sentiment side, funding rates provide a crucial clue. According to top analyst On-Chain Mind, the 30-day average of Bitcoin perpetual funding rates is currently very low. This reflects a lack of excessive greed and typically marks a favorable setup for bullish continuation. Historically, periods of low funding rates have preceded major upward moves, especially when paired with strong macro tailwinds. With economic pressure building and Bitcoin still in a bullish structure, the coming days could define the next major move for the world’s largest cryptocurrency.

Calm Before The Breakout: Bitcoin Gains Strength Above $107K

Bitcoin is up more than 3% since the start of July, holding firmly above the $107,000 local low despite repeated resistance at the $110,000 level. This sustained strength signals underlying buyer support and growing momentum as BTC continues to consolidate just below all-time highs. The $110K resistance remains a critical ceiling — once breached, analysts expect a strong move into price discovery as bullish momentum builds.

So far, the market has digested a wave of macroeconomic and geopolitical developments. Global trade dynamics — including rising tariffs, export restrictions, and deglobalization trends — continue to shape sentiment. Yet, compared to the sharp volatility seen earlier this year, both Bitcoin and US equities appear more resilient. This suggests that much of the uncertainty has already been priced in, reducing the downside risk for risk assets like BTC.

A key technical factor reinforcing the bullish case is the low 30-day average of funding rates. This indicator reflects a neutral-to-cautiously optimistic market environment — a stark contrast to overheated bullish phases that often precede corrections. Calm periods like this often set the stage for explosive moves, particularly when supply squeezes and strong demand meet a macro environment ripe for risk-taking. With BTC coiling tightly and sentiment balanced, a breakout could be imminent.

Related Reading

BTC Holds Steady as Bulls Eye $109,300 Breakout

The 4-hour chart shows Bitcoin (BTC) consolidating within a tight range, holding above the key support at $107,000 and testing resistance around $109,300. This price level has consistently acted as a local ceiling, with several failed breakout attempts in late June and early July. However, the bulls continue to defend higher lows, signaling strength and setting the stage for a potential breakout.

The 50, 100, and 200 simple moving averages (SMAs) are stacked close together and gradually trending upward, suggesting the consolidation phase could soon transition into a more directional move. Volume remains low, which often precedes a volatility spike, especially near key resistance levels.

Related Reading

The $103,600 support remains the crucial line in the sand for bulls. A breakdown below that level would invalidate the short-term bullish structure and likely lead to a deeper retrace. On the upside, a daily close above $109,300 with volume confirmation could trigger a rally toward price discovery above the all-time high.

Featured image from Dall-E, chart from TradingView