ST. LOUIS — The oceans are becoming more dangerous, and satellites are being called in to help.

Demand for space-based maritime surveillance is accelerating, driven by rising geopolitical tensions, economic chokepoints and illegal maritime activity, according to a new report from the market research firm Quilty Space.

The firm’s findings spotlight a global push by governments and industries to improve maritime domain awareness (MDA), the all-encompassing term for tracking what ships are where, carrying what, and doing what.

“In maritime domain awareness, timeliness is often the deciding factor between actionable insight and stale data,” the report states.

From piracy to geopolitics

Quilty Space points to a sharp uptick in disruptive maritime events over the past five years as a major driver of demand. Incidents like Houthi attacks on vessels in the Red Sea, Chinese naval assertiveness in the South China Sea, piracy off West Africa, and climate-driven bottlenecks such as Panama Canal droughts have exposed vulnerabilities in global shipping networks.

“Events once considered rare are now regular features of the maritime operating environment,” the report says, adding that these developments are reshaping how governments and commercial fleets assess risk and plan routes.

Also pushing adoption of satellite surveillance: the global fight against illegal fishing, especially as nations move to counter activities by China’s distant-water fleets. With fishing stocks under pressure and enforcement budgets stretched, space-based intelligence is offering a way to cover more ground — or water — with fewer resources.

Latency a bottleneck

Even as more satellites are launched, getting data fast enough to act remains a critical challenge. Users typically expect maritime intelligence within 30 minutes of collection. But if the satellite isn’t immediately in contact with a ground station, delays of two hours or more are common — “at which point the intelligence was effectively useless,” the Quilty report states.

Latency becomes especially problematic when tracking elusive targets like ships that switch off their transponders or veer from known routes. These so-called “dark ships” are often involved in smuggling, piracy, or illegal fishing.

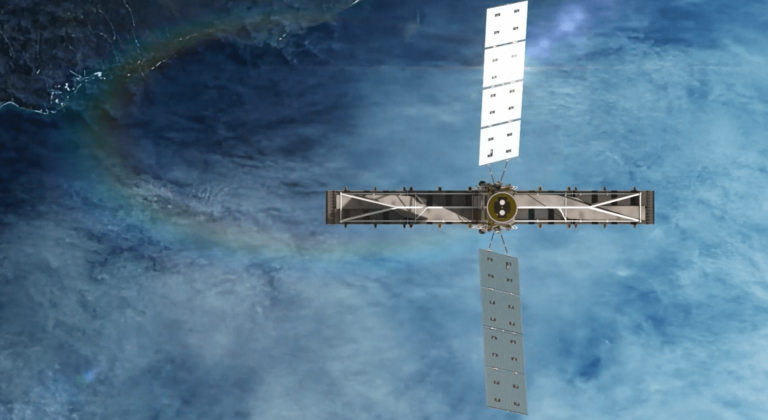

The report identifies onboard processing as a promising solution. Rather than beaming raw data down to Earth for analysis, newer satellites are being designed to process radar and other signals in space. One example is Canada’s MDA Space, which is building the Chorus constellation of radar satellites. Scheduled to launch its first satellite in 2026, Chorus will process data in orbit to deliver rapid intelligence to defense and intelligence agencies.

Layering sensors

Traditional ship tracking relies on the Automatic Identification System (AIS) — a transponder-based network mandated by international maritime law. But AIS is increasingly vulnerable to spoofing and manipulation, undermining its reliability.

To fill the gaps, companies are adopting a “tip and cue” model, where one sensor — such as a radio frequency (RF) detector — identifies a suspicious signal and prompts an imaging satellite to capture visual or radar data. Low Earth orbit satellite constellations equipped with optical, synthetic aperture radar (SAR), hyperspectral and RF sensors enable multi-layered surveillance of vast ocean areas.

But integrating these diverse data sources and platforms remains technically complex and costly. Ground infrastructure is another hurdle. Large, distributed ground station networks can improve data turnaround, but come with high operational costs and geographical limitations.

“Achieving comprehensive maritime domain awareness demands fusing data from both space and terrestrial sources and integrating multiple sensor types,” Quilty concludes. “No single sensor platform can capture the full picture alone.”

NGA tests commercial solutions

U.S. defense and intelligence agencies are increasingly tapping commercial innovation to close maritime intelligence gaps. Last year, the National Geospatial-Intelligence Agency (NGA) issued a call for commercial solutions to track maritime activity.

The first commercial solutions award was made last year to Orbital Insight, now owned by Privateer, for maritime surveillance capabilities that support military and homeland defense operations.

NGA Deputy Director Brett Markham said the agency has extended Orbital Insight’s pilot contract.

Speaking at the GEOINT Symposium May 18, Markham said the agency would continue the pilot project initially awarded last year for a six-month period. He said the program is helping NGA better understand commercial options for unclassified intelligence.

The Department of Defense is also investing directly in maritime surveillance satellites. California-based Umbra, which operates SAR satellites, recently secured a Strategic Funding Increase (STRATFI) contract from the U.S. Air Force to develop a next-generation constellation. The goal: deliver wide-area radar coverage and tip-and-cue capabilities for maritime security missions.