Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

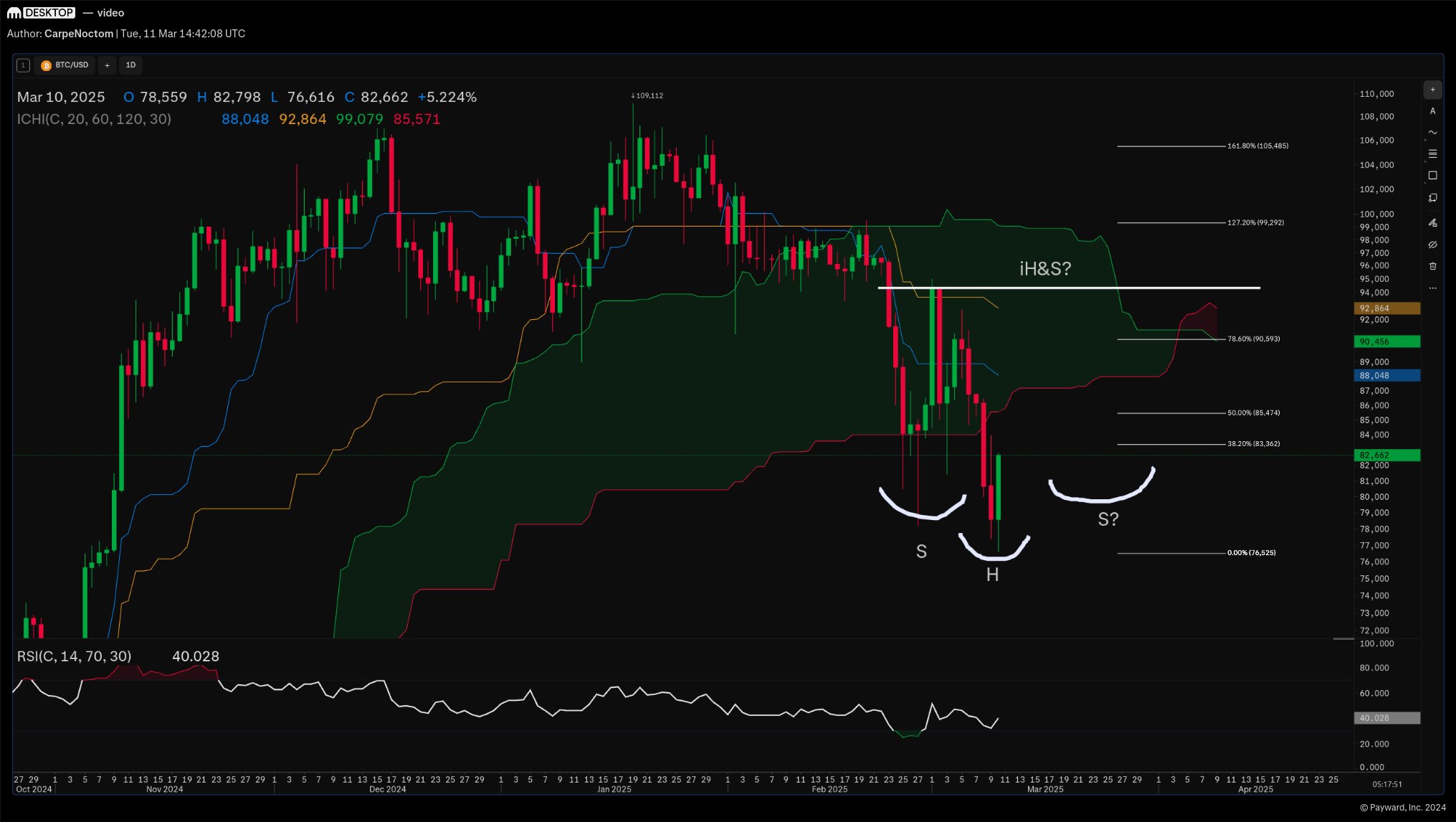

Bitcoin (BTC) remains at a critical juncture, holding above its yearly pivot level. In his latest market analysis, seasoned crypto trader Josh Olszewicz outlined key technical factors that could determine Bitcoin’s next move in his latest video analysis, emphasizing the importance of RSI divergences, volume trends, and candlestick formations.

With BTC experiencing heavy downward pressure over the past few weeks, Olszewicz examined whether the market has reached an exhaustion point for sellers or if further downside remains likely.

Is The Bitcoin Bottom In?

A crucial observation in Olszewicz’s analysis is the presence of bullish divergence on both RSI and volume, a pattern that historically signals a potential trend reversal. He noted: “BTC for the moment is holding at the yearly pivot, it’s holding at the OG Pitchfork here, and we did put in a bullish divergence on both RSI and volume. We got a lower low in price, higher low in RSI on lower volume.”

Related Reading

This setup mirrors similar conditions observed in August and September, where Bitcoin saw relatively equal lows in price, but RSI formed significantly higher lows. While this does not guarantee an imminent reversal, Olszewicz pointed out that it increases the probability of a potential upside move, especially if further confirmations arise.

From a candlestick perspective, Bitcoin’s price action is exhibiting early signs of potential stabilization. Olszewicz highlighted the significance of Dragonfly Doji formations, particularly in combination with bullish engulfing candles, which often signal seller exhaustion and trend reversals.

“What I would love to see on many of these charts is what we’re already seeing on the daily—a green Dragonfly candlestick. It’s a small body with a long wick, showing clear rejection of lower prices. If confirmed, this could be an early bottoming signal.”

However, he cautioned that while these patterns can be indicative of a shift in market sentiment, they are not foolproof and require additional confirmation from price structure and momentum indicators. Moreover, Olszewicz added via X: “BTC iHS brewing? Way too early to call this definitively but we’ve got the early trappings of a multi-week bottom here. Would align with a potential kumo breakout in Q2 and measures to an ATH retest. Something to monitor throughout March, a new LL would likely negate this possibility.”

Olszewicz advised traders to remain disciplined and avoid over-leveraging positions in volatile conditions. He stressed the importance of maintaining a consistent trade sizing strategy and avoiding emotional decision-making. “You don’t have to make it all back in one trade. You don’t have to revenge trade. Confidence drops in times of chaos, and that’s when most people make mistakes.”

Related Reading

He also warned against blindly dollar-cost averaging into assets simply because they appear heavily discounted: “Just because something is down 80% doesn’t mean it’s an automatic buy. The technicals might look great today, but that doesn’t mean it won’t keep going lower. That’s why risk management is key.”

While the broader macroeconomic landscape remains uncertain—with ongoing tariff concerns and mixed signals from traditional markets—Bitcoin’s technical positioning suggests that a potential relief rally could emerge in the coming months.

Olszewicz suggested that March and April could be pivotal periods for Bitcoin, where a clearer trend could develop. However, he reiterated that for now, traders should focus on high-probability setups rather than speculative plays. “If BTC can stabilize here and reclaim key levels, the case for a stronger recovery into Q2 strengthens. But it’s too early to make that call. Right now, the best strategy may simply be to wait for high-confidence setups.”

At press time, BTC traded at $81,599.

Featured image created with DALL.E, chart from TradingView.com